Excitement About Transaction Advisory Services

The Single Strategy To Use For Transaction Advisory Services

Table of ContentsNot known Incorrect Statements About Transaction Advisory Services 8 Simple Techniques For Transaction Advisory ServicesSome Known Questions About Transaction Advisory Services.3 Simple Techniques For Transaction Advisory ServicesThe Greatest Guide To Transaction Advisory Services

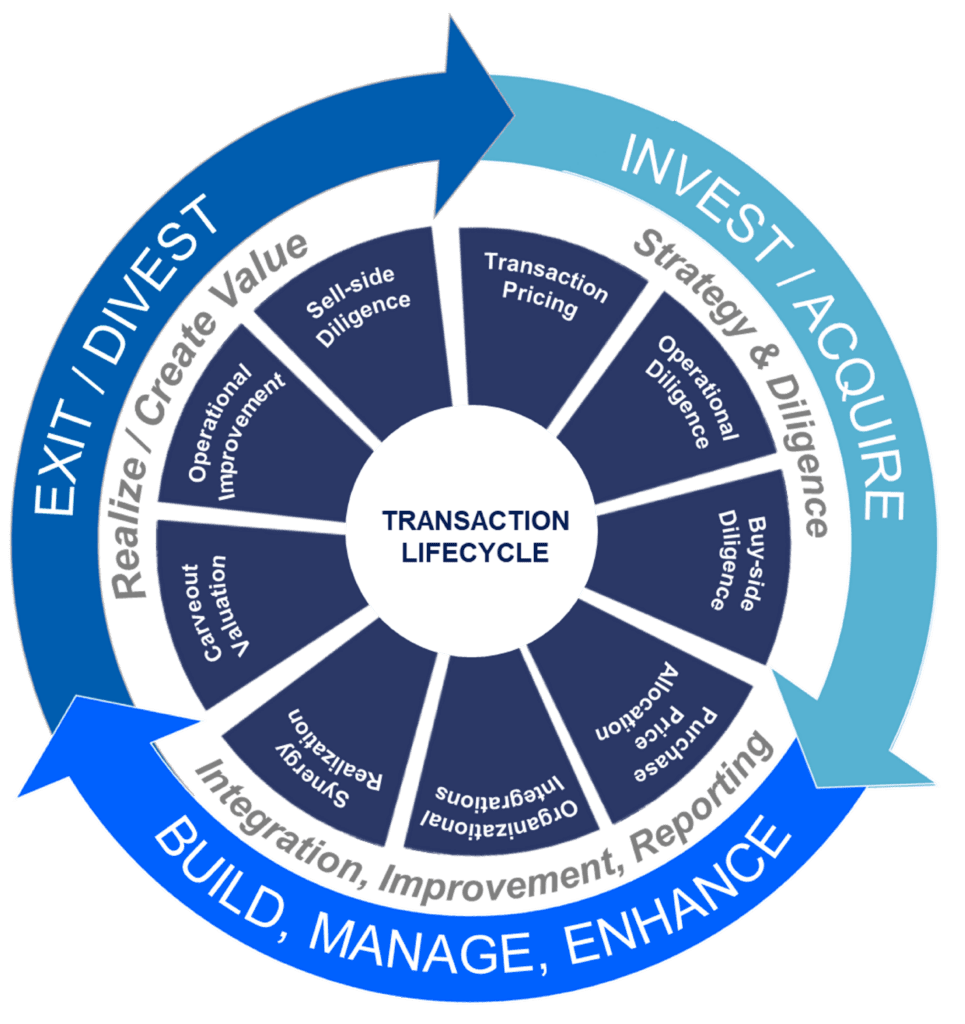

This action ensures business looks its ideal to prospective buyers. Getting business's worth right is important for an effective sale. Advisors utilize different techniques, like discounted cash flow (DCF) analysis, comparing with similar companies, and current transactions, to figure out the reasonable market value. This aids establish a fair cost and discuss properly with future buyers.Purchase advisors action in to help by obtaining all the required information arranged, addressing inquiries from buyers, and preparing brows through to the company's place. This constructs trust with buyers and maintains the sale moving along. Obtaining the very best terms is key. Transaction advisors utilize their expertise to help local business owner handle challenging settlements, satisfy purchaser expectations, and framework offers that match the owner's objectives.

Fulfilling legal rules is critical in any service sale. They aid organization proprietors in planning for their following actions, whether it's retired life, starting a new venture, or managing their newfound wealth.

Deal advisors bring a wealth of experience and understanding, making certain that every aspect of the sale is handled properly. Via critical preparation, assessment, and arrangement, TAS assists company owner accomplish the highest possible list price. By making sure lawful and regulative compliance and handling due persistance together with various other offer group members, purchase consultants reduce potential dangers and responsibilities.

Transaction Advisory Services Fundamentals Explained

By contrast, Big 4 TS teams: Service (e.g., when a prospective purchaser is carrying out due persistance, or when an offer is shutting and the purchaser requires to incorporate the firm and re-value the vendor's Equilibrium Sheet). Are with costs that are not connected to the bargain shutting efficiently. Make costs per involvement somewhere in the, which is less than what investment banks earn even on "small deals" (but the collection possibility is likewise a lot greater).

, however they'll concentrate a lot more on audit and appraisal and less on subjects like LBO modeling., and "accountant just" topics like trial equilibriums and exactly how to walk through occasions utilizing debits and credit ratings find this instead than monetary statement modifications.

The Facts About Transaction Advisory Services Revealed

that demonstrate exactly how both metrics have actually altered based on items, channels, and consumers. to judge the accuracy of monitoring's past forecasts., consisting of aging, inventory by item, typical levels, and provisions. to identify whether they're completely imaginary or somewhat credible. Experts in the TS/ FDD teams might also talk to administration about every little thing above, and they'll compose a comprehensive record with their searchings for at the end of the procedure.

, and the general shape looks like this: The entry-level duty, where you do a whole lot of data and monetary analysis (2 years for a promotion from here). The following degree up; comparable job, however you get the more interesting little bits (3 years for a promo).

Specifically, it's challenging to get promoted beyond the Supervisor degree since few people leave the job at that phase, and you need to start revealing proof of your ability to generate income to development. Let's start with the hours and way of living given that those are less complicated to define:. There are occasional late nights and weekend break work, yet nothing like the frantic nature of financial investment banking.

There are cost-of-living changes, so expect reduced payment if you remain in a less costly place outside significant monetary facilities. For all placements except Companion, the base salary makes up the mass of the overall settlement; the year-end benefit could be a max of 30% of your base pay. Frequently, the very best way to boost your earnings is to change to a various firm and discuss for a higher income and incentive

Rumored Buzz on Transaction Advisory Services

At this phase, you must simply stay and make a run for a Partner-level function. If you want to leave, maybe move to a client and perform their appraisals and due diligence in-house.

The main trouble is that due to the fact that: You usually require to sign up with one more Huge 4 group, such as audit, and work there for a couple of years and after that move into TS, work there for a couple of years and after that move into IB. And there's still no warranty of winning this IB duty since it depends upon your region, customers, and the employing market at the time.

Longer-term, there is likewise some risk of and due to the fact that assessing a business's historical financial details is not specifically rocket scientific research. Yes, humans will always need to be entailed, yet with more advanced modern technology, lower head counts could possibly support client involvements. That said, the Purchase Solutions team defeats audit in terms of pay, job, and exit possibilities.

If you liked this short article, you could be curious about reading.

Transaction Advisory Services - The Facts

Establish sophisticated economic structures that assist in determining the real market price of a firm. Supply advisory operate in connection to service valuation to help in bargaining and pricing frameworks. Clarify one of the most ideal type of the deal and the type of factor to consider to employ (cash money, stock, gain out, and others).

Perform assimilation preparation to identify the procedure, system, and business changes that might be needed after web the deal. Establish guidelines for incorporating departments, technologies, and organization processes.

Analyze the prospective consumer base, industry verticals, and sales cycle. The functional due persistance provides crucial insights into the functioning of the company to see this site be acquired concerning danger analysis and value development.